Successful fundraising and international expansion for the Group

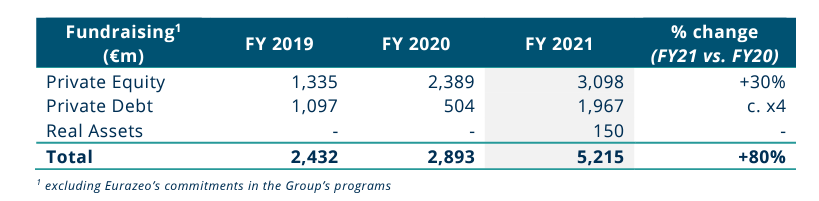

In 2021, the Eurazeo Group set a new record, raising funds of €5.2 billion from limited partners, up 80% compared to 2020 and +125% compared to the average over the last 3 years.

The consecutive records set in the past three fiscal years illustrate the successful development by Eurazeo of its asset management activity and reflect the appeal of its investment strategies to major international American, European and Asian investors. In this respect, the Group benefited fully from its global expansion strategy: in 2021, international clients represented around two-thirds of the fundraising, compared to less than one quarter previously.

Eurazeo also confirmed its status as European leader in private markets for individual clients: out of total fundraising of €5.2 billion in 2021, this buoyant segment collected €550 million, around double the amount raised in 2020. Thanks to its distribution partners in private banking and international wealth management, the Group is one of the few in Europe capable of offering savers and HNWI (High Net Worth Individuals) access to private market performance through innovative securities account or unit-linked funds.

Renowned investment strategy expertise

Eurazeo benefited from the performance of its investment teams and their positioning in buoyant segments. In 2021, several of its divisions closed fundraising programs above initial targets.

In Private Equity, Eurazeo received new commitments of €3.1 billion in 2021, up more than 30% compared to 2020 :

- Growth and Venture fundraising exceeded €1.1 billion in 2021 thanks to the Group’s renowned leadership in the Tech industry, with the closing above initial target of one of Growth’s largest funds in Europe (EGF III) at €1.6 billion;

- Buyout strategies raised €1.4 billion over the period, benefiting from the successful launch of the 4th Small Mid Buyout (PME IV) program and the development of co-investment opportunities in existing programs.

- Private Funds Group fundraising surpassed €500 million in 2021, notably with the closing of the Secondaries (ISF IV) program above expectations.

In Private Debt, the Group raised around €2.0 billion in 2021, roughly four times the 2020 amount.

- In the highly vigorous mid-market unitranche segment, where Eurazeo is one of the European leaders, the Group closed the fundraising of its fifth Direct Lending (IPD V) program above expectations and successfully launched a successor fund in 2021;

- The Group launched an innovative fund to finance the decarbonization of maritime infrastructures (ESMI), which is “Article 9” classified under the SFDR, combining Eurazeo’s Asset Based Financing expertise and its ESG commitment;

- Finally, Eurazeo was selected to manage €280 million in Recovery Bonds (Obligation Relance) under a program initiated by the French Insurance Federation (FFA) and the Caisse de Dépôts et Consignations.

Fundraising prospects in 2022 and 2023

Eurazeo will roll out a major fundraising program in 2022 and 2023 to further its ambitious growth and address the increasing demand from investors.

Virginie Morgon, Chairwoman of the Executive Board, declared :

“The record amount of fundraising in 2021 reflects our appeal to international investors which see in Eurazeo good diversification, major sector expertise, particularly in Tech and Healthcare, a capacity for innovation, and a strong sustainable growth commitment. In a complex environment, we help businesses develop and support the transformation to a low carbon and more inclusive economy to secure performance and responsibility for our investors and the companies in which we are shareholder”.

Eurazeo financial timetable

| 10 March 2022 | 2021 annual results |

| 28 April 2022 | 2022 Shareholders’ Meeting |

| 19 May 2022 | Q1 2022 revenue |

| 27 July 2022 | H1 2022 results |

| 8 November 2022 | Q3 2022 revenue |