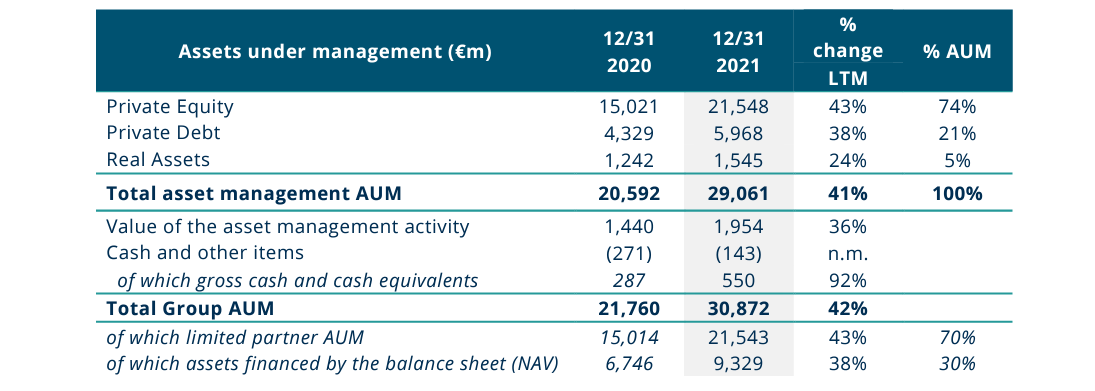

Assets Under Management (AUM) up +42% over 12 months to €31bn

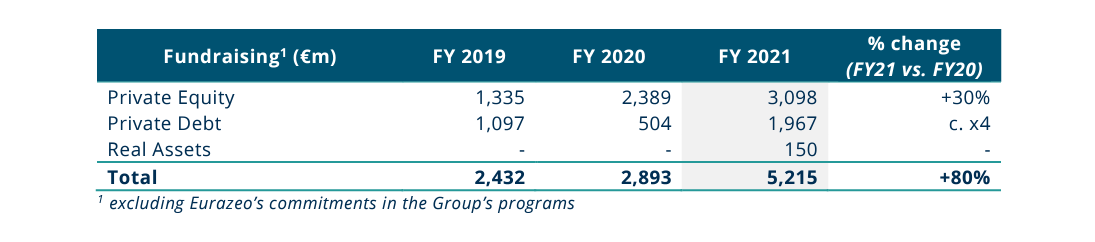

- Fundraising up +80% to €5.2bn

- Management fees up +27% to €309m, including +38% from limited partners

- Fee Related Earnings (FRE) up +30% to €93m

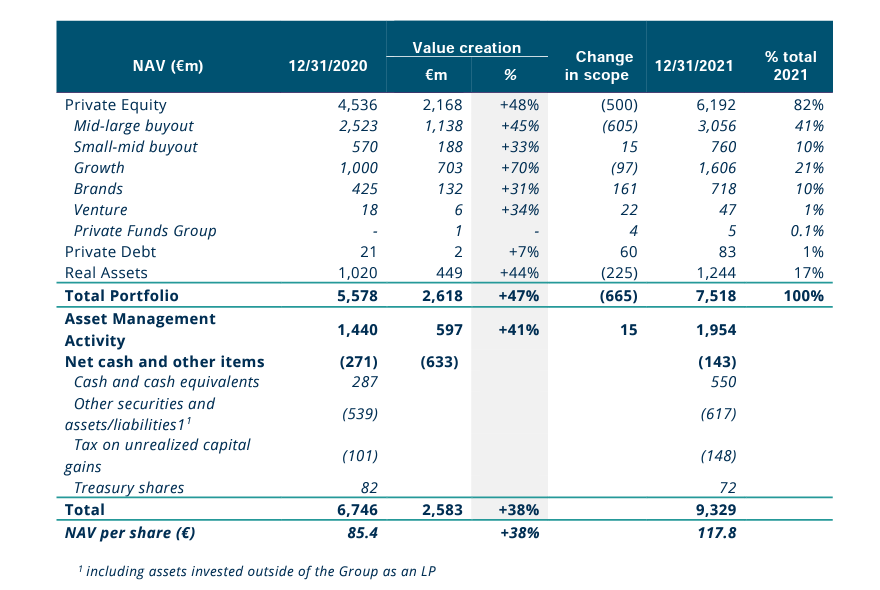

Net Asset Value (NAV) per share up +40% to €117.8, dividend included

- Substantial value creation for all portfolio strategies, including €8 per share additional value through exits, and for the asset management activity

Record performance and significant financial leeway

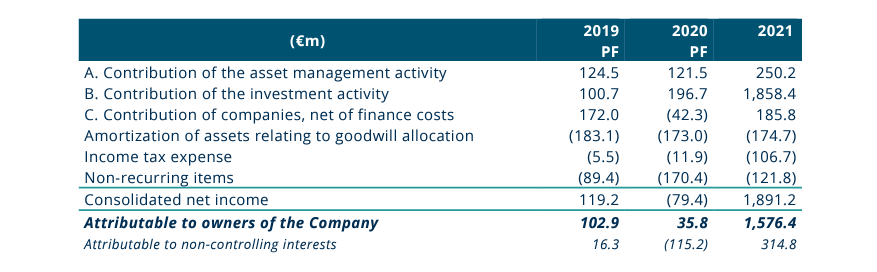

- Net income attributable to owners of the Company: €1,576m

- Gross cash and cash equivalents as of December 31, 2021: €550m

- €1.5bn confirmed and fully undrawn revolving credit facility

Recognized ESG leadership

- CO2 emission reduction trajectory validated by SBTi

- Improved “low risk” Sustainalytics rating (top 3% in the “Asset Management” category)

Proposed distribution of €3 per share

- Ordinary dividend: €1.75, up +17%

- Exceptional dividend: €1.25, given excellent results in the year

Growth trajectory revised upwards: doubling of AUM expected in 5-7 years (€60bn in 2026-2028)

Virginie Morgon, Chairwoman of the Executive Board, stated:

« Eurazeo has topped the €30 billion mark in assets under management and delivered a historic result. The Group’s model is powerful: with a record net asset value of €117.8, the strong value creation across all asset classes is a testament to the quality of Eurazeo's investment strategies and the mobilization of its teams. The Group’s performance and reputation also led to an excellent year of fundraising with institutional and retail clients. In a difficult and uncertain international environment, Eurazeo's model is resilient. It relies on solid foundations to continue its momentum: choices of highpotential investment sectors, particularly in the digital and environmental transition, an international presence alongside entrepreneurs and investors, further strengthened ESG leadership and expertise nurtured by the recruitment of new talent in all our geographical presence. The 2021 record results and the confidence of the management team and the Supervisory Board in our model lead us to propose a substantially increased dividend distribution to the Shareholders' meeting. »

1. ASSETS UNDER MANAGEMENT AND DEPLOYMENT

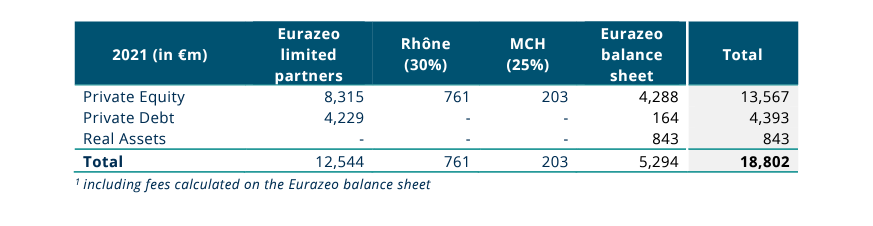

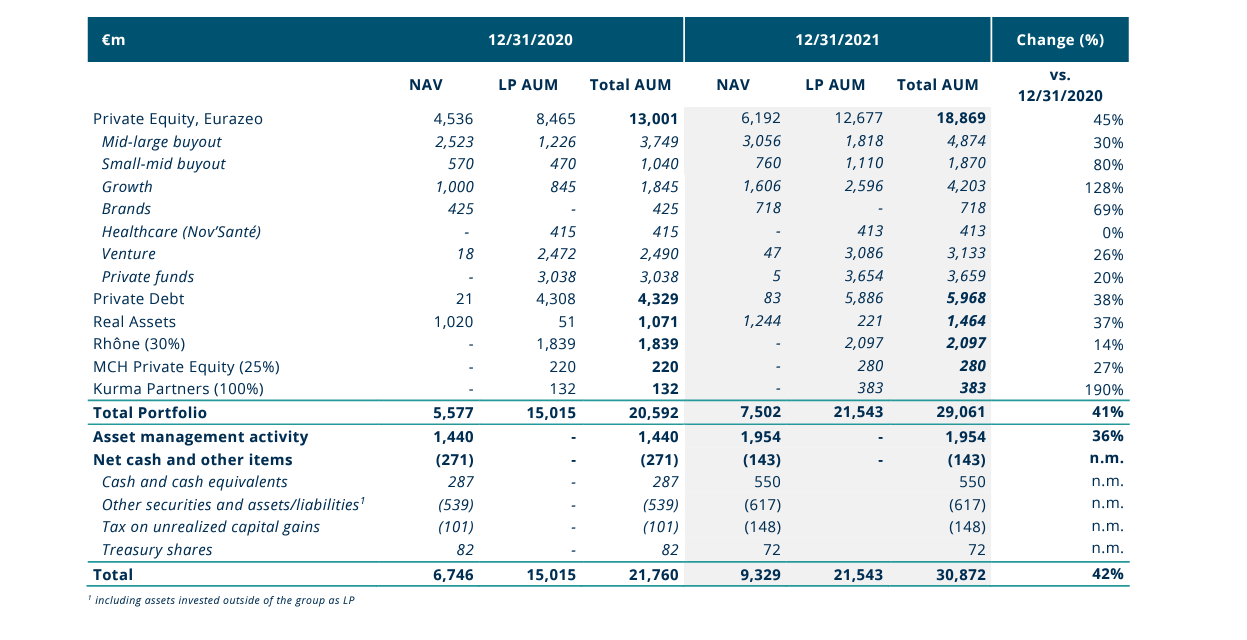

In 2021, Eurazeo Group Assets Under Management (AUM) totaled €31bn, up 42% over 12 months.

Eurazeo manages limited partner (LP) AUM of €21.5bn, up 43% compared to 2020, and assets financed by the Group’s balance sheet (Net Asset Value, NAV) of €9.3bn, up 38% year-on-year (+40% per share, dividend included).

In 2021, Eurazeo raised €5,215m from limited partners, i.e. 80% more than the amount raised in 2020. The Group finalized the fundraising of three flagship programs, all of which surpassed their initial target:

- the third Growth program exceeding €1,600m

- the fourth Secondaries program totaling €1,000m

- the fifth Private Debt program exceeding €2,000m. The timely deployment of capital enabled the launch of a sixth program which already completed its first close at the end of 2021.

Furthermore, the fourth Small-mid buyout program, launched in H1 2021, has already secured over €800m (including €400m from Eurazeo’s balance sheet) and will continue its fundraising in 2022, aiming to reach a target of around €1bn.

A breakdown of fundraising is shown in Appendix 1

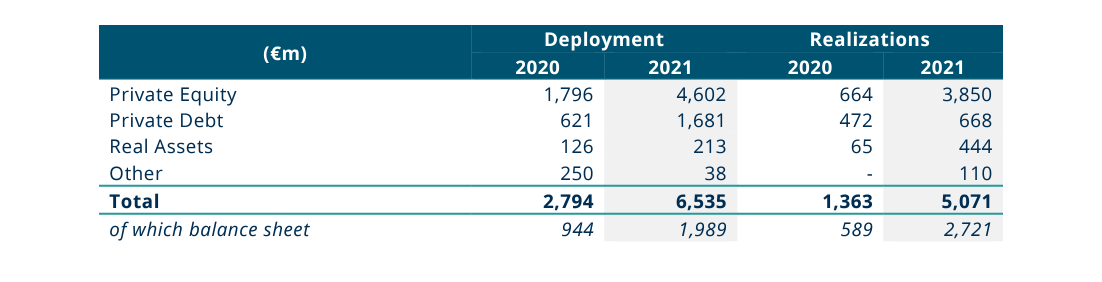

Group deployment surged in all asset classes, totaling €6.5bn in 2021 (including a balance sheet share of €2.0bn) compared to €2.8bn in 2020. The Group has set up divisions offering cross-cutting sector expertise in buoyant segments such as healthcare, consumer goods, financial services and tech and digital. These expertises enable the Group to enjoy a very rich dealflow and remain particularly selective in its deployment in a context of high prices.

Completed realizations also rose sharply to €5.1bn (including a balance sheet share of €2.7bn), as the Group continued its ambitious asset divestment program in a buoyant environment. Several new major deals were completed or announced (e.g. Trader Interactive, Grandir, Seqens, Orolia, In’Tech, Adjust, and Planet) with a weighted average cash-on-cash multiple of 2.4x.

A breakdown of deployment and realizations is shown in Appendix 2

2. NET ASSET VALUE (NAV)

As of December 31, 2021, NAV per share totaled €117.8, up +38% compared to December 31, 2020 and +40% including the dividend paid in 2021. All of the Group’s assets are unlisted.

Gross value creation of the portfolio held on the balance sheet totaled €2,618m, up +47% in 2021. All Group division companies increased significantly in value due to their stellar operational performance (see below), the amounts raised from the financing rounds of Growth companies (Payfit, ManoMano, Content Square, Vestiaire Collective, BackMarket, Younited) and realizations completed or announced in excellent conditions. This enabled around €8 per share in additional value to be incorporated into NAV compared to the most recent valuation of these assets as of December 31, 2020.

The asset management activity (+41% in value creation) benefited from the excellent operating performance (sharp increase in AUM, FRE and PRE) and the increase in sector multiples. However, the multiples used by the Group to value this activity remain lower than the current multiples of listed peers.

Limited short-term impact on NAV from recent markets downturn

Since the beginning of 2022, the stock market is significantly down due to the evolution of economic conditions and the impacts of the war in Ukraine.

The Group estimates that the impact on its published NAV is so far limited thanks to 1) cautious hypotheses used to determine this NAV, especially for the most volatile assets and the asset management activity. This prudent valuation partly reflected the market correction; 2) the quality and diversity of its portfolio, and especially the weight of promising sectors which are little impacted, such as healthcare or energetic transition; 3) very limited exposure to Russia and Ukraine; 4) several exits signed totaling nearly €1.0bn.

A sensibility analysis on our NAV, applying spot multiples as of March 8, 2022, would have according to Group management a limited impact of around 6-8%.

3. FINANCIAL RESULTS AND CONSOLIDATED FINANCIAL STATEMENTS

Net income attributable to owners of the Company reached an all-time high (€1,576m in 2021, compared to €36m in 2020). The contributions of the asset management activity, investment activity and portfolio companies all rose sharply compared to 2020 and the pre-COVID level, at constant Eurazeo scope.

A. CONTRIBUTION OF THE ASSET MANAGEMENT ACTIVITY

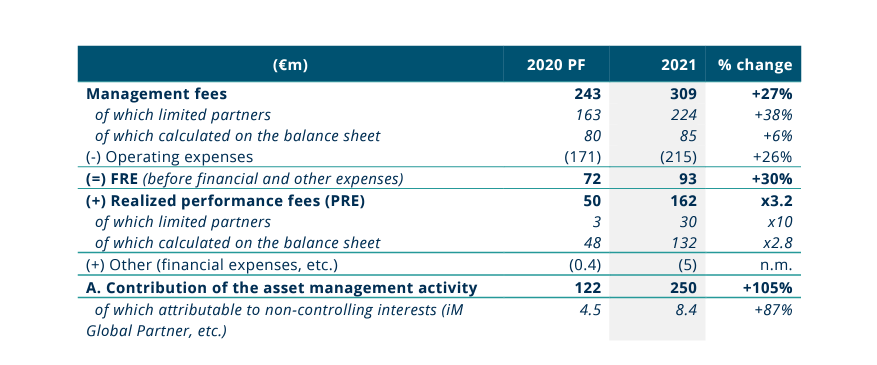

In 2021, the asset management activity doubled its contribution, with a sharp increase in its revenue, recurring income (FRE) and performance fees (PRE).

The development of this strategic business creates numerous synergies within the Group, mainly through risk diversification, the greater investment universe, the increase in the share of recurring foreseeable income, the leverage impact on costs and the appeal for talents.

Management fees increased by +27% to €309m and break down as follows: i) management activities for limited partners up +38% to €224m, driven by successful fundraising in 2020 and 2021; ii) management fees calculated on the balance sheet of €85m, up slightly by +6%, considering the numerous realizations which reduced the fee paying AUM calculation base;

The Group’s operating expenses totaled €215m, up +26%. They comprise all Eurazeo Group recurring costs (excluding Group strategic management costs).

Fee Related Earnings (FRE), which measure the activity’s net recurring income, totaled €93m in 2021, up 30% compared to 2020. This improvement was attributable to the growth in management fees and the controlled increase in costs despite the strengthening of teams in a context of rising AUM and further international expansion.

Performance fees were substantial during the period. They comprise €132m calculated on the balance sheet, mainly relating to the realizations during the year, and a sharp increase in fees from limited partners (€30m compared to €3m in 2020).

B. CONTRIBUTION OF THE INVESTMENT ACTIVITY

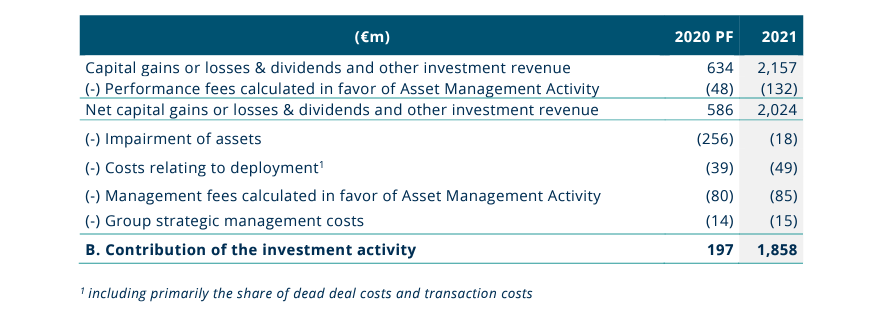

Investment activity net income soared to €1,858m in 2021, compared to €197m in 2020.

Revenue from capital gains totaled €2,157m (€634m in 2020). It mainly comprises divestment capital gains (€1,630m) and the change in fair value of the Growth portfolio (€385m).

Asset impairment was very limited (-€18m) and considerably lower than in 2020.

C. CONTRIBUTION OF COMPANIES, NET OF FINANCE COSTS

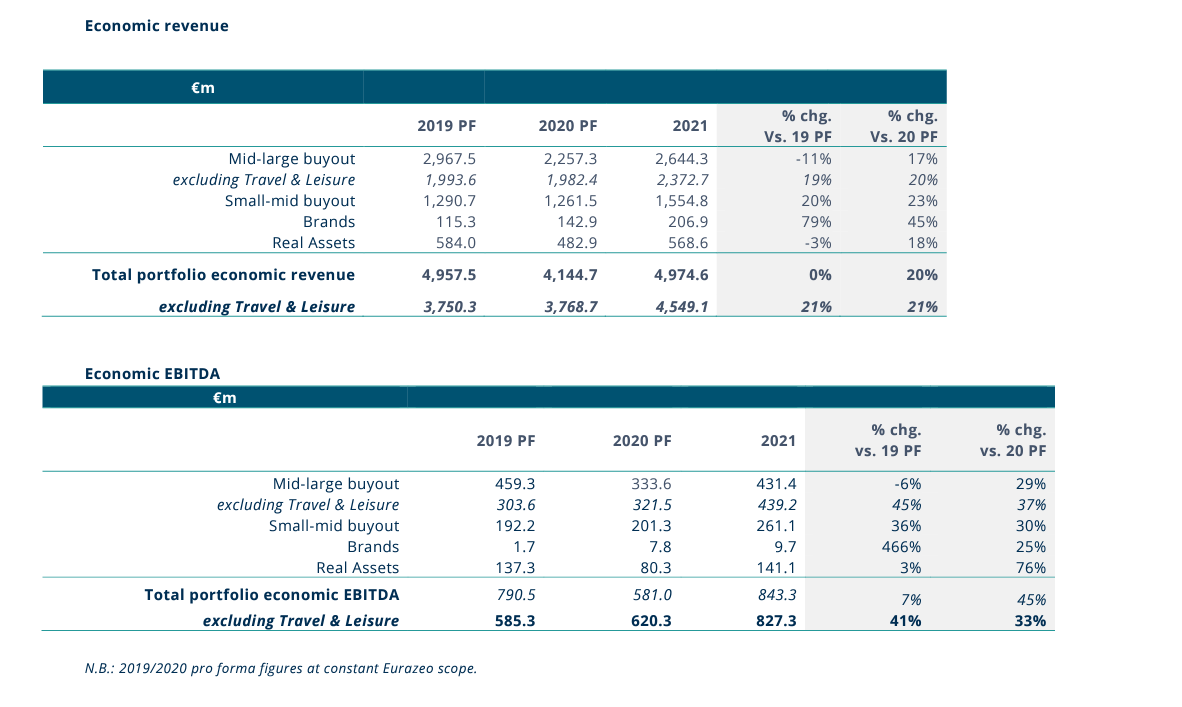

Strong growth in economic results during 2021

Excluding Travel & Leisure, the portfolio reported solid growth in 2021. Economic revenue at constant Eurazeo scope rose by +21% in 2021, compared to 2020 and pre-COVID 2019. Economic EBITDA increased by +33% compared to 2020 (+41% compared to 2019 at constant Eurazeo scope).

The revenue of companies exposed to the Travel & Leisure segment increased by 13% compared to 2020. The economic EBITDA of these companies rose to €16m (€3m in 2020) and shows encouraging signs of recovery.

Growth portfolio companies benefit from their digital native positioning and reported average revenue growth of 52% in 2021, taking into account a high comparable base (+45% in 2020). These companies are not consolidated and their revenue is therefore not reflected in the Group’s economic revenue.

A breakdown of the portfolio's performance is shown in Appendix 3.

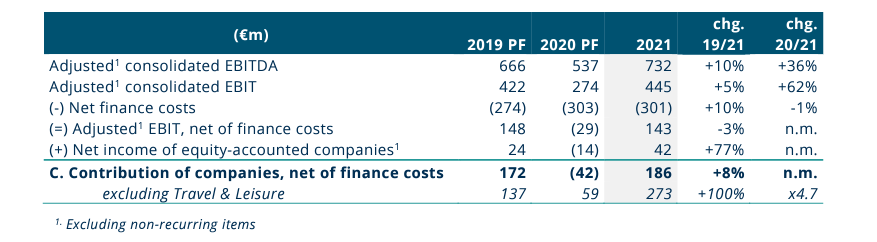

Contribution of consolidated companies up sharply, including compared to 2019

Adjusted1 EBITDA and EBIT of fully consolidated companies totaled €732m and €445m, respectively, in 2021 (growth of +36% and +62%, respectively, compared to 2020).

Finance costs were overall stable (-1% to €301m) despite new deployment and completed buildups.

The contribution of portfolio companies, net of finance costs, amounted to €186m in 2021, up significantly compared to 2020 (-€42m) and up +8% compared to 2019 at constant Eurazeo scope. Excluding the Travel & Leisure segment, this represented a 100% increase.

D. NON-RECURRING ITEMS AND DEPRECIATION AND AMORTIZATION

Non-recurring items, which mainly relate to the portfolio companies, totaled -€122m in 2021, a sharp decrease compared to 2020 (-€170m).

4. BALANCE SHEET AND DIVIDEND POLICY

A. EURAZEO BALANCE SHEET

Eurazeo’s cash and cash equivalents stood at €550m as of December 31, 2021, compared with €287m as of December 31, 2020. The main changes compared to December 31, 2020 primarily involved deployment and redeployment totaling €2.0bn, total or partial realizations for €2.7bn, share buybacks of €24m and the paid dividend for €115m. The Group has no structural debt at Eurazeo SE level.

The Group has an undrawn confirmed revolving credit facility of €1.5bn.

At the end of December 2021, the Group held 2.5 million treasury shares, i.e. 3.1% of total outstanding shares (79,224,529 shares).

At the same date, the Group had €4.7bn in dry powder (undrawn commitments from limited partners).

B. DIVIDEND POLICY

The Eurazeo Executive Board proposes an increase of 16.7% in ordinary dividend payment to €1.75, and a special dividend of €1.25, totaling to €3 per share with respect to the 2021 financial year. This substantial increase is supported by the growth in recurring revenue from the Asset Management Activity, the Group's financial robustness and the excellent results in 2021.

5. ESG COMMITMENT

As an ESG (environmental, social and governance) pioneer for nearly 20 years, Eurazeo has again sought to boost value creation in the ESG sector with the 2020 launch of its “O+” ESG strategy.

The Group’s ESG commitment is recognized by non-financial rating agencies with, for example, an improvement in the Sustainalytics rating to “Low Risk”, ranking the Group in the top 3% of the “Asset Management & Custody Services” category.

Committed to accelerating the emergence of a low carbon and more inclusive economy, Eurazeo has incorporated ESG criteria into each of its investment strategies, as illustrated by the Article 8 or 9 classification under the new European Disclosure regulation (SFDR) for 83% of its rolledout or raised funds.

Eurazeo continued to strengthen its thematic funds, with the objective of pursuing sustainable development as defined in Article 9 of Regulation (EU) 2019/2088, with :

- ESMI (Eurazeo Sustainable Maritime Infrastructure) which backs innovation, energy transition and maritime sector decarbonization projects;

- Eurazeo Transition Infrastructure Fund, which invests in sustainable infrastructures supporting the energy and digital transition in Europe;

- Nov Santé, a fund worth over €400m created at the initiative of a group of major institutional investors, invests in the healthcare sector (research, production and services) as part of the French “Recovery” plan.

The Group is the first Private Equity management company to submit a decarbonization trajectory calculated using the SBTi methodology (Science Based Target Initiative). This SBTi trajectory was approved in early 2022.

With respect to inclusion, women accounted for 50% of hirings in the past 12 months, raising the company’s gender diversity rate to 44%. Finally, in addition to the company’s standard employee share ownership plan, a capital increase reserved for Group employees carried out in the spring 2021 proved highly successful, with over 90% of employees subscribing, and boosted the sharing of value creation within the Group.

Furthermore, executives signed a shareholders’ agreement, which any of the Group's employee can join. This agreement seeks to coordinate voting intentions prior to shareholders’ meetings. Group executives and employees already hold around 1.9% of Eurazeo’s share capital.

6. OUTLOOK

Despite the current international tensions and market volatility, trends remain structurally buoyant for the Group, with investors continuing to boost their allocation to private equity markets.

Exposure to the war in Ukraine

The direct exposure of the Group's portfolio to Ukraine and Russia is very limited, either in terms of revenue or production chain.

Eurazeo is carefully monitoring the indirect effects of the war in Ukraine, particularly the increase in raw materials and energy prices, as well as induced general inflation.

Expected fundraising in 2022

The Group has reached a new fundraising milestone with €5.2bn raised in 2021. Considering the number and relevance of funds in the market in 2022, Eurazeo is confident this momentum should continue thanks to:

- flagship funds, with new Mid-large buyout, Digital (Venture), Growth and Private Debt vintages;

- the first fundraisings in divisions hitherto financed exclusively by the balance sheet;

- capital raising for numerous specialized and “bespoke” funds satisfying the specific needs of limited partners and private wealth management clients.

To date, the Group has secured €550m of fundraising in 2022.

Doubling of assets under management expected in 5-7 years

Given the current fundraising momentum and the increase in the value of assets, the Group has revised its growth trajectory upwards and plans to double its assets under management, which could reach €60bn, in 5 to 7 years under normal market conditions.

Increase in the share of ESG funds

As a leader in ESG, the Group aims to increase the share of its assets under management with a sustainable development objective, as defined in Article 9 of the European SFDR (EU 2019/2088) regulation.

Growth in the asset management activity margin

The Group confirms its objective to increase the FRE margin in the medium term to 35-40%, from around 30% in 2021. The rate of this growth will depend on fundraising, completed realizations and hirings made to prepare for the expansion.

Realization program

Realizations planned in 2022 should be within the historical average in proportion to net assets. The divestments of Reden Solar and Orolia, which should be finalized this year, have already been announced. The number of realizations should again be particularly high in 2023.

7. SUBSEQUENT EVENTS

A. ASSET ROTATION

- Eurazeo announced the acquisition, through its Mid-large buyout strategy, of Cranial Technologies, the market leader in treating infant plagiocephaly. Eurazeo’s majority investment will support Cranial Technologies’ expansion across the US and in other key international markets.

- The Real Assets team continued to roll out its European program in the hospitality sector with the acquisition of a hotel in Bordeaux, a portfolio of six multi-purpose business complexes in Germany and a new asset in London in February.

- Eurazeo and PSP Investments, one of Canada’s largest pension investment managers, have announced a strategic partnership and plan to invest equity of up to €150m. It will focus on investing in hotels across Europe. A first investment in Spain has been announced.

- Early march, Eurazeo has reached an agreement to sell its 47% stake in Reden Solar, a European independent producer of renewable photovoltaic energy. This sale was based on a €2.5bn Enterprise Value, ie a 4.3x Cash-on-cash and an IRR of 42%.

- Kurma Partners announced the 1st closing of its Growth Opportunities at €160m. To respond to the growing maturity of European biotech and healthcare ecosystem, this new fund, which should eventually raise €250m, aims to accelerate the growth of the best European companies in the Healthcare sector.

B. GOUVERNANCE

- At its meeting on March 8, 2022, based on a proposal made by the Compensation, Appointment and Governance Committee, the Eurazeo Supervisory Board decided to appoint Jean-Charles Decaux as Chairman of the Supervisory Board. He will succeed Mr Michel David-Weill who has decided not to seek renewal of the position of Chairman which he has held since 2002.

- As proposed by Virginie Morgon, whose term of office as Chief Executive Officer was renewed on November 29, 2021, the Supervisory Board has renewed the terms of office of the Executive Board’s other members (Christophe Bavière, Marc Frappier, Nicolas Huet et Olivier Millet) for four years and appointed William Kadouch-Chassaing to replace Philippe Audouin, who is retiring.

APPENDIX 1: FUNDRAISING

MAIN FUNDRAISING IN 2021

A. PRIVATE EQUITY

- Mid-large buyout (formerly Eurazeo Capital): The Group raised co-investments of €715m in 2021 under existing programs and for an ambitious continuation fund for Planet. The new Mid-large buyout program should be launched in 2022;

- Small-mid buyout (formerly Eurazeo PME): following its successful third program, the Group secured over €800m (including a Eurazeo balance sheet commitment of €400m) for its fourth program as of December 31, 2021. The previous fund had raised €0.7bn in total (including a Eurazeo balance sheet share of €0.4bn);

- Growth: the third Growth program announced its final closing at over €1.6bn (including a Eurazeo balance sheet commitment of €320m), thereby surpassing its target and confirming the strong appeal of the investment strategy. This amount includes €0.3bn from a secondary deal and €0.2bn from private banking;

- Venture: in 2021 the Group announced the €80m first closing of the Smart City II fund which seeks to invest in the most promising innovative digital companies in mobility, energy, proptech and logistics to help cities accelerate their transition and enhance their resilience against crises;

- Private Funds Group: Eurazeo announced the final closing of its fourth investment program for secondary transactions at €1bn. Funds of €700m were raised by Idinvest Secondary Fund IV, exceeding the initial target of €600m, and additional secondary capital of €300m was raised with retail clients. In 2017, the previous program had achieved commitments of €570m;

B. PRIVATE DEBT

- Direct lending: Eurazeo announced the final closing of its fifth direct lending fund at €1.5bn, ahead of its initial €1.2bn target. Along with €500m in private debt funds and investment mandates, Eurazeo’s fifth Private Debt program now totals €2.0bn. The quicker-than-expected deployment of capital in the last quarters led to the launch of the successor program (EPD VI) which has already secured around €800m with an overall target at least equal to that of the previous program.

- Corporate Loans: Eurazeo was selected by delegation to manage €280m for the Recovery Bonds (Obligations Relance) Fund. The fund is set up to finance the long-term growth and transformation of French SMEs and midcaps. These investments should focus on boosting the equity of companies and achieving ESG targets, particularly in ecological transition.

- Asset-based financing: In 2021, the Group launched the ESMI (Eurazeo Sustainable Maritime Infrastructure) fund, with the objective of pursuing sustainable development as defined in Article 9 of Regulation (EU) 2019/2088. This fund, which blends the asset financing know-how of teams and the Group's sustainable development commitment, backs maritime economy transition projects aiming for carbon neutrality by 2050. Around €200m have already been secured to date with several renowned sovereign and institutional investors.

C. REAL ASSETS

Eurazeo and PSP Investments, one of Canada’s largest pension investment managers, have announced a strategic partnership in which PSP plans to invest up to €150m. It will focus on investing in hotels across Europe, targeting large assets or portfolios well-positioned to benefit from the sector’s recovery.

APPENDIX 2 : DEPLOYMENT ACTIVITY

A. PRIVATE EQUITY

Deployment

- Mid-large buyout (formerly Eurazeo Capital): Questel (intellectual property management solutions in SaaS mode) and Planet (digital payment) boosted their development with four buildups each. The acquisition of a majority stake in Aroma-Zone, a pioneering French company making and distributing aromatherapy, natural beauty and wellness products, was finalized in early July 2021. This acquisition completes Eurazeo Capital IV’s investment phase. Mid-large buyout continued to expand its strategy in the US with the acquisition of Scaled-Agile (provider of professional training content and certifications);

- Small-mid buyout (formerly Eurazeo PME): the Group completed the acquisition of Altaïr (premium homecare products) and supported the acquisition by UTAC of its competitor Millbrook in the United Kingdom, thereby doubling its revenue. The Group also acquired majority stakes in the Premium Group (personal finance) and I-TRACING (cyber security);

- Growth : the Group announced several investments in MessageBird (the world’s leading global omnichannel communication platform) to support the company’s development in the United States and Neo4j (the leader in graph database technology), Growth’s first US investment. The Group reinvested in several of its current investments through new financing rounds (Payfit, ManoMano, Content Square, Vestiaire Collective, BackMarket, Younited);

- Brands : the Group announced the signing of an exclusive agreement to acquire a majority interest in Ultra Premium Direct (high-end petfood) and a minority interest in Pangaea (men’s care). In H2 2021, Eurazeo strengthened its position with the acquisition of a majority stake in Beekman 1802, a growing US clean beauty brand. Eurazeo acquired a minority stake in Jaanuu, a designer and manufacturer of premium, performance-oriented medical apparel and accessories;

- Venture : the strategy supported the growth of technology companies including investments in Jow and Cubyn;

- Healthcare : Nov Santé acquired a minority stake in the Novair Group alongside the founding family and completes its second investment.

Realizations

- Mid-large buyout

- Sale of 49% of Trader Interactive (digital marketing platform for the purchase and rental of recreational and commercial vehicles in the United States), the Mid-large buyout team’s first investment, which generated a multiple of 2.8x its initial investment;

- Sale of the entire investment in Planet (e-payments) to Advent, generating a cash-on-cash multiple of 2.5x and an Internal Rate of Return (IRR) of around 19%. On this occasion, Eurazeo reinvested alongside Advent to obtain joint control of Planet;

- Sale of 41% of Grandir, a leading operator of nurseries and preschools in France, Europe and North America. Eurazeo earned a 2.0x return on its initial investment;

- Sale of the investment in Seqens, an integrated global company specializing in pharmaceutical solutions and specialty ingredients, for a multiple of 1.8x the initial investment;

- Small-mid buyout

- Sale of the majority stake in the In’Tech group (manufacturing of orthopedic surgical instruments), generating a cash-on-cash multiple of 3.0x and an IRR of 31% for Eurazeo.

- Signing of the sale of its majority stake in the Orolia group, world leader in R-PNT solutions and applications. With this deal, Eurazeo is set to achieve a cash-on-cash multiple of 3.6x and an Internal Rate of Return (IRR) of around 25%.

- Growth

- Sale of Adjust (mobile attribution, measurement and fraud prevention) to AppLovin. Eurazeo earned a 2.5x return on its initial investment and an IRR of 57%.

B. PRIVATE DEBT

Deployment and realizations

Deployment and realizations for the period totaled €1,681m and €668m, respectively.

C. REAL ASSETS

Deployment

In January 2021, the Real Estate team acquired Johnson Estate, an office building complex in London comprising four buildings with a total surface area of 18,000 sq.m., for an equity investment of around €79m.

The roll-out of the European program in the hospitality sector continued in H1 2021 with the acquisition (premises and business) of a portfolio of 8 hotels located in the west of France for around €16m.

The People Hostels completed 3 new acquisitions (premises and business) in H1 2021 for a total equity investment of around €12m in order to boost its coverage in France.

In H2 2021, as part of a logistics sector investment program, the team completed the acquisition, in partnership with Arax Properties, of Trinity Trading Estate, a multi-let trading complex. This acquisition represented an equity investment of around €27m for Eurazeo.

The acquisition of an 80% stake in Ikaros Solar, a Belgian solar PV company, was completed in December 2021 via an investment commitment of €45m. This first investment is in line with the Eurazeo’s goal to invest in the energy and digital transition and contribute to a low-carbon and sustainable economy.

Under the strategic partnership signed with Investments PSP, an initial acquisition has already been signed: FST Hotels, a Spanish hotel group that owns and operates an 800-room portfolio across five hotels, primarily located in Madrid and Barcelona.

Realization

The sale of the C2S clinics group, signed in December 2020, was finalized in June 2021. This deal generated a cash-on-cash multiple of 3.2x and an Internal Rate of Return (IRR) of approximately 47% for Eurazeo.

APPENDIX 3 : PORTFOLIO PERFORMANCE

APPENDIX 4 : STRATEGIC PARTNERSHIPS

iM Global Partner (AUM not consolidated)

Assets Under Management of iM Global Partner, a global network dedicated to asset management, totaled $38.6bn as of December 31, 2021, up 97% compared to December 2020 (+41% vs. June 2021), due to the outperformance of its affiliates, steady high collection momentum and the acquisition of 100% of Litman Gregory, which was closed in Q2 2021, as well as deals to acquire 45% of Richard Bernstein Advisors and 42% of Asset Preservation Advisors, which were respectively closed in July and September 2021. Litman Gregory is a recognized wealth management and multimanagement company, with $4bn in assets under management and $2.2bn in advised assets. The intention is to integrate this company into the iM Global Partner Group. Richard Bernstein Advisors ($14.5bn in AUM) is a renowned investment management firm specializing in index-based asset allocation and Asset Preservation Advisors ($4.9bn in AUM) is an investment management company that focuses on municipal bonds. Both companies will partner iM Global Partner, based on the traditional revenue and distribution fee sharing business model.

iM Global Partner’s assets under management are not included in Eurazeo Group's AUM.

In Q1 2021, Eurazeo sold 20% of its investment in iM Global Partner. The deal generated sales proceeds of around €70m for Eurazeo, i.e. a cash-on-cash multiple of 2.1x and an Internal Rate of Return (IRR) of 21%. Following the transaction, Eurazeo held 52% of the share capital.

Rhône Group (7% of AUM)

Investments: In February 2021, Fund V acquired a 20% equity stake in Illy caffè S.p.A., a premium coffee brand, to assist in the acceleration of its global growth and the development of exit considerations. In August 2021, Fund V acquired a 58% controlling stake in Wahoo Fitness, a leading designer of connected fitness equipment. In December 2021, Fund VI acquired Paragon Films, Inc., a market leading manufacturer of ultra-high performance stretch films.

Distributions : Rhône distributed approximately €1.3 billion of capital during 2021, including €0.8 billion of capital to investors in Rhône Funds and €0.5 billion to co-investors.

MCH Private Equity (1% of AUM)

In 2021, MCH invested over €100m via its various funds under management, including around €70m via its flagship fund MCH Iberian Capital Fund V.

MCH Iberian Capital Fund V already has 6 portfolio companies. In 2021, 3 investments were added to Molecor (development of molecular innovations for the manufacture of PVC-O pipes), Prosur (agro-food producer) and Llusar (citrus fruit producer).

APPENDIX 5 : FEE PAYING AUM1

APPENDIX 6 : ASSETS UNDER MANAGEMENT

Eurazeo financial timetable

| 19 May 2022 | Q1 2022 revenue |

| 27 July 2022 | H1 2022 results |

| 8 November 2022 | Q3 2022 revenue |